01 April 2024

Transaction volume moderated further in 1Q 2024 amid the festivities, economic uncertainty and elevated interest rates. Despite this, the all-residential property price index recorded a moderate uptick.

Buyers are more cautious when committing to home purchases due to a combination of factors. These factors include looming economic uncertainty, rising retrenchment numbers, and elevated interest rates. Furthermore, buyers are taking more time to decide on a purchase with the increased housing options, stemming from more new homes being launched and a rise in resale listings due to recent home completions. Others are deferring their home purchases, hoping for better deals if interest rate cuts materialise in the 2H 2024.

Strong new sale performances, as seen at Lentor Mansion and the brisk sales of the remaining units at Cuscaden Reserve, underscore buyers’ interest in the new homes segment. But homebuyers have more considerations today beyond just location. New homes that fall within the $2-$2.5 mil price quantum or have considered functionality and sustainability needs will continue to appeal to majority of the buyers today.

OCR and RCR continue to see marginal price growth led by new home completions which helped uplifted resale prices in the regions.

We foresee a resurgence in buyers’ interest with several highly anticipated new home launches scheduled over the next few months. The forecasted interest rate cuts could also help boost buyer interest in the second half of 2024.

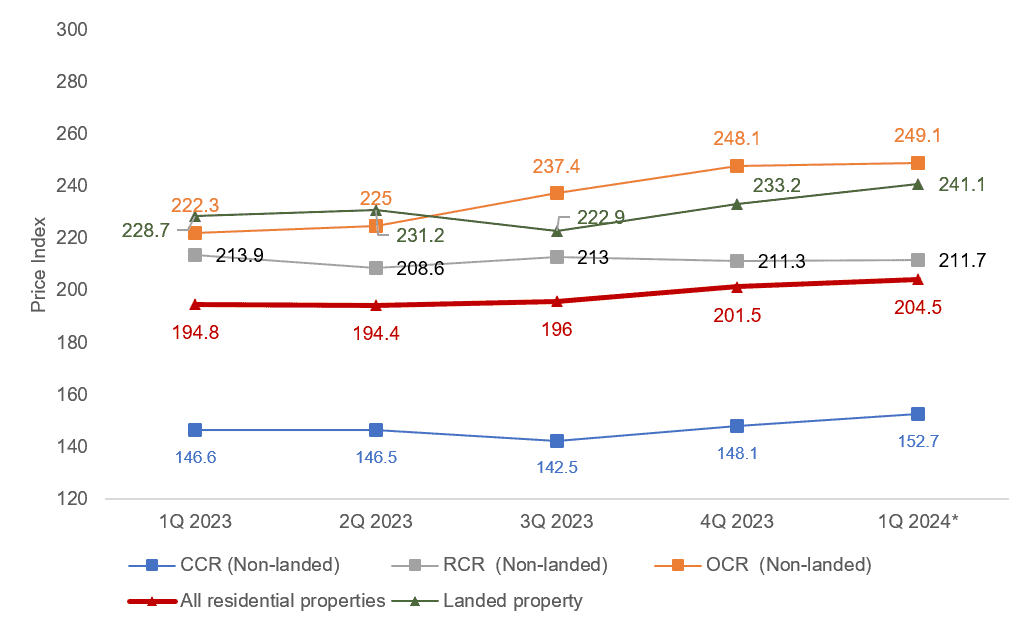

Residential Home Prices

Based on flash estimates, the All-residential property price index reported a modest quarter-on-quarter (q-o-q) increase of 1.5% in 1Q 2024.

Prices of non-landed properties increased by 1.0% in 1Q 2024, compared to the 2.3% increase in the previous quarter. Prices of non-landed properties in the Outside Central Region (OCR) and the Rest of Central Region (RCR) increased moderately by 0.4% and 0.2% q-o-q. By contrast, prices of non-landed properties in the Core Central Region (CCR) rose by 3.1% q-o-q.

Prices of landed properties rose 1.5% q-o-q at a slower pace compared to the 2.8% q-o-q growth in 4Q 2023.

Chart 1: Residential Price Indices

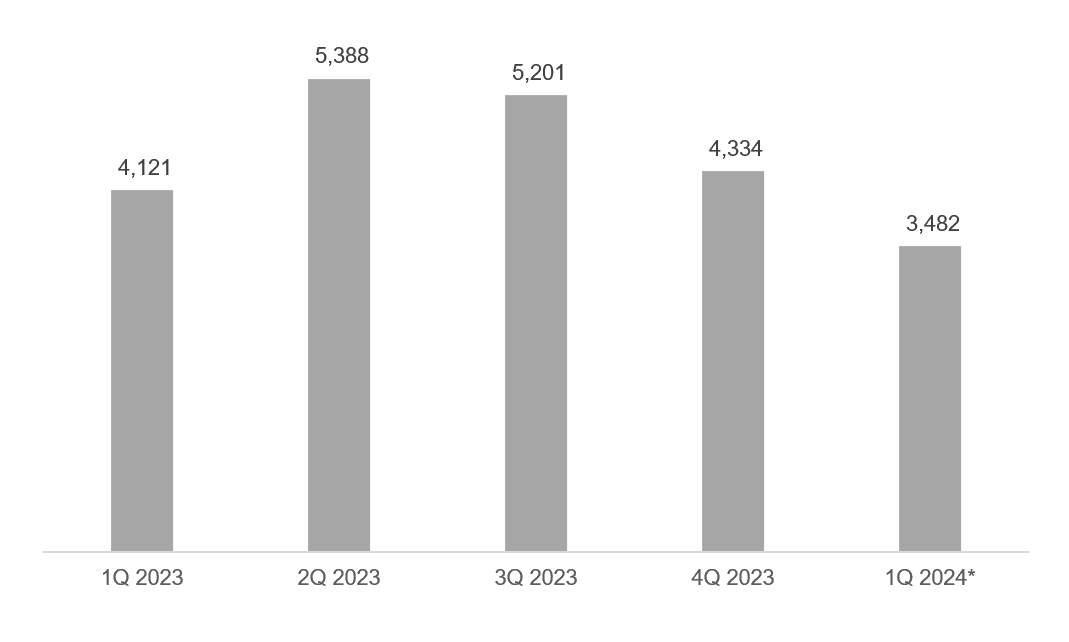

Property Transaction Volume

Sale transaction volume fell by about 20% q-o-q and by about 16% y-o-y in 1Q 2024.

Chart 2: Property Transaction Volume

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.